After recent discussions about interest rate rises, comments from the Deputy Governor of the Bank of England, John Cunliffe that an interest rate rise was an 'open question' undermined that strength. The $ ended firmer, partly as a result that John Taylor is expected to increase interest rates faster than the currently projected rate.

Last year the UK had good quality wheat and we exported about 1.4mt of it, to the point where we were very short in the latter months of the harvest year and had to import 1.9mt which left us with an official carry-out of about 1.6mt (about 2.8mt the previous year). If it had not been for the early harvest in August this year, many feed millers would have run out of wheat, so the trade believes that the carry out was much less than 1.6mt, possibly 1.2mt.

The UK grain trade’s estimates of this year’s production were in the region of 14.2-14.8mt wheat this year, which using the lower carry-out would leave us with a negative exportable surplus (requirement to import). Then DEFRA issued its UK wheat production estimate of 15.2mt. Using the 1.6mt carry-out with DEFRA’s 15.2mt means that we could have an export capability of 1.1mt – if DEFRA is correct. The trade is left scratching its collective head, and struggling to make sense of the huge difference between official figures and listening to their gut.

There is a North-South wheat price differential of about £8-10/t, which we referred to and explained last month, and it is still with us; as the South has mainly grown feed wheat and by default has the cheapest wheat in the country at about £140 delivered to the mill. The North-South divide may also explain the difference between official figures and the trades’ guestimations, if all the July wheat stocks were in the North.

At the recent AHDB Outlook conference, Jack Watts presented this graph demonstrating that we are on a knife-edge in terms of needing to import and export, and that can change significantly within a harvest year. About two years ago the UK had the cheapest wheat in the world, and now we have the most expensive wheat in the world on a like-for-like basis. Currently Russian/Black sea wheat is the cheapest, followed by the EU. Russia has had a massive harvest this year and is expected to export 32mt compared to the EU which is expected to export about 28mt, thus Russia is mopping up most of the export opportunities, whilst France has taken a back seat since August and is only now starting to compete. It is thought that France was waiting until Russia had depleted its stockpile, but as estimates of Russia’s harvest increased, France would have had to wait until New Year by which time the Australian harvest would be ready.

Against this background, with the UK not being export competitive, it is thought that wheat prices are likely to remain steady until the New Year. This is not unusual as November is always a big month for moving the physical grain due to the November’s futures contracts, and farmers are always busy preparing next year’s crops and pursuing their hobbies rather than selling wheat. More clarity on the carry-in stocks and UK wheat production this year will give better direction on wheat prices.

UK November futures are virtually unchanged on the week. The nearby November futures position is about to expire (147 lots of Open Interest), so our focus will switchs to May futures which ended the week at £147/t.

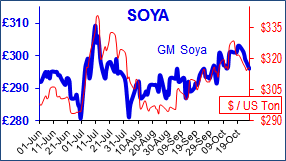

The soya story is all about stocks and weather affecting future production. The good news is that global soya ending stocks are high at about 100mt of which about 50% are held in Argentina, compared to global demand of 340mt. Argentinean stocks are high due to a number of reasons including export taxes, inflation and currency exchange. The not so good news is that it is too wet in Argentina and too dry in Brazil at this critical planting time. Next year, Brazil is expected to produce 109mt (114mt this year) and Argentina 55mt (58mt this year). However, the possibility of a La Niña event occurring has increased to about 60% probable. China is expected to import about 95mt soya this year, slightly less than anticipated as their pig numbers have declined by 75m to about 650m over the past three years. Although the Chinese love pork, they do not enjoy the pollution, so have cleared many of the pig farms that were close to cities and river systems; there have also been disease issues. As China’s demand for soya starts to plateau, this may start to cause soya prices to ease.

In the UK, soya prices are determined more by currency when there is a global sufficiency of soya. GM soya is just under £300 delivered to the mill.

Four hundred stone structures have been found in Harrat Khaybar in Saudi Arabia, by an archaeologist using Google Earth. The structures are 50cm high, up to 500m long and estimated to be 2000-9000 years old. The area is volcanic and the structures seem to be associated with lava domes, out of which lava flowed to form the current lava fields. Most of the structures are rectangular (like gates), but others are round or kite-shaped. The structures are known to the Bedouin as the ‘Works of the Old Men’, and the kite-shaped structures were used to catch migratory birds.