May 2019 wheat futures have been remained steady with little change to the price currently at £173/T with very little movement all week trading with a high of £175.50 over the week as physical trade remains slow.

With little news or activity on the wheat market the trade awaits news political stories or more certain signs of winter for its next move. Brexit has continued to be at the centre of the UK news with focus on stockpiles and just how much worse off the UK is with each possible outcome – there can be some volatility in each day of trade for the currency markets.

The US and European markets both finished higher despite the December contracts nearing the end helped by gains in maize. Snow in the US has stopped winter wheat planting. For the 7% gain in total wheat acres predicted in the USDA report, spring acreage will need to be higher than usual. Talks were scheduled between China and the US over the past weekend we will have to await the outcome and potential effects. News was equally quiet elsewhere with no further developments in disruption of shipments between Russia and the Ukraine and the trade generally believing that Russia’s exports will remain stable over the end of the year rather than the feared sharp fall, despite a slower November export pace. There are still reports that phyto-sanitary certificates are becoming harder to source, but we are yet to see the official ban on exports many expect.

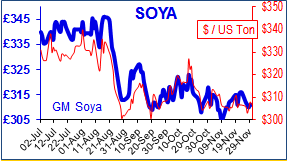

Chicago soya prices lifted at the prospect of constructive talks between the US and China with a combination of protective short covering, and some cautious optimism that a deal will be reached. With reducing time left for the US to mount a recovery from the effects of the trade war seen so far and reports that storage for both soya and maize predicting this market is becoming ever more difficult. The words of President Xi defending free markets and China’s interest in widening access to import products, provided hope that this trade dispute may be nearer to a resolution. However news of a possible meeting between President Trump and President Vladimir Putin regarding the Russia-Ukraine aggression is adding further concern and interest in US trade and the G-20 talks. Once again there are more `unknowns’ this week, and we will have to wait to see what happen and what effect these political debates will have on the commodities we all work with. Deal or no deal? Trade or no trade?

After a long day, you finally sit down with a cold beer ready to relax, when you notice a fly. Why?! How do the pesky little things know just when to turn up?

Scientists at the Institute of Technology in California believe they know. After decades of science telling us fruit flies are do not like CO2, they now think like most insects they find CO2 an attractant – which makes sense given Drosophila melanogaster fruit flies eat yeast, a single celled fungi that produces CO2 as it ferments sugars. This study took just 6 years to complete with thousands of experiments with both beer and wine. We are sure none of it was wasted!

But it does not end there; scientists believe the aroma compounds that produce the smell and taste of beer may have been evolved just to attract flies to help spread the yeasts genetic material. So next time a fly appears over your beer remember you have them to thank for this cold refreshing delight.