Currency remains at relative lows following the delay to the Brexit deadline but has stabilised over the last few days. It remains one to watch as (if!) any developments are announced.

UK feed wheat future recorded the third lowest trading volumes on Thursday. Prices moved to £166/T on Friday up £5 from recent lows. Old crop is currently trading at £165.5/T while new crop retains the recent price differential of £18-20 at £146.50 across much of the differential, and in the south is a little larger at £23.

Baltic wheat is being offered £140 FOB (Free On Board – loaded on to ship) which is pressuring farm prices to compete. Selling volume is therefore currently at low levels. The technical selling (trading on the back of futures activity) is still the only real action, causing erratic movements on occasions, but this is reduced from last week. There is little trade on the July 19 futures contract, so most of focus is the old vs new crop price spread, which remains high for this stage of the season. Consumers are still mostly either over bought or waiting as prices currently move sideways.

Conditions in the US remain positive, compared to last year, for both wheat and maize which continues to drive the markets lower. The US funds extended their net short (sold) position, at 19%, which is the greatest net short position in open interest since records started in 2006/07. The large short is even more remarkable considering the currently high projected level of end of season stocks expected in the US. As global supply estimates continue to grow, Europe and the UK markets continue to follow the US, despite the possible tight supply situation expected in the UK – so the timing of when the first new crop appears could be critical. IGC’s latest estimates for wheat production for the 2019/20 season are up 3 Mln T globally to 762 Mln T. Russian wheat production figures were close to 80 Mln T, up from 77 Mln T at the last forecast. These levels would allow stocks to be rebuilt from this season’s vast selling on what was a small crop. This may encourage Russia to pull off what was thought to be `the impossible’ for most of this season - and continue to sell till the end. The EU also increased its wheat production figure, all be it more subtlety from 140.2 Mln T to 141.3 Mln T. EU maize estimates remained stable.

News for the Soya bean market remains similar. The US is set for a huge end of season stock and still relying on a further 6.1 Mln T still to be sold and exported this season to prevent the estimate increasing. Rainfall in the US continues to add doubt to the level of maize planting adding further pressure as soya beans will be the farmers’ next choice. The Argentinian harvest is 11% ahead of average figures relative to the 2013-18 seasons, and good weather is expected over the coming weeks, allowing further good progress.

Soya bean markets continue to be given no break as the US and China trade talks are scheduled for early May, but still have more vital issues to agree on such as rules and `enforcement for intellectual property’ and `technology transfer’ despite the rumour that the end is in sight. The negative pressure continues from African swine fever reducing China’s commodity requirement, but it could be said that the meat will come from somewhere and will need feeding. The US soya, and other commodity markets are perhaps in a prime position to gain from this less direct route.

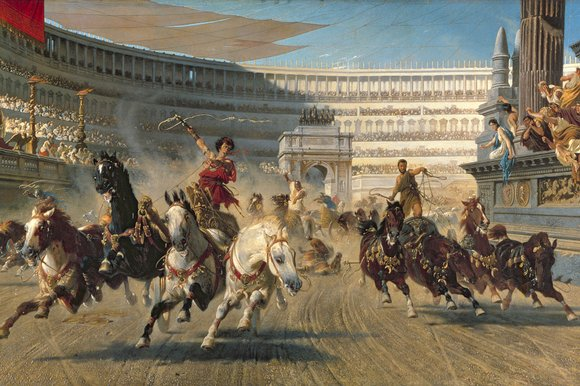

Many sports fans treat their sport, and especially their team, almost like a religion. Team stars can become heroes, and rivalries between teams can be fierce. In Roman times these passions were demonstrated for chariot racing.

Chariot racing was as integral to the Romans as Football is to many today. It was the one event at which all sections of society were able to attend together, from the patricians in the emperor’s box to the plebeians who gained free entry. Unlike today’s sports, fame came not just by winning, but by surviving. The teams wore colours often associated with political alignment, and spectators were encouraged to sabotage the opposing teams by throwing lead amulets studded with nails at the racers and horses. Now that is a real sport for hooligans! The event was often used to measure support for the current emperor – or lack thereof - who always chose between blue and green.

Unlike Greeks racers, the Roman racers were tied to the horses at the wrists so letting go in a crash was not an option. They were given a knife in this event, but we suspect that being dragged by your arms at speed under panicking horse’s feet with other chariots likely to run you over makes slicing a whisp of leather a bit of a challenge!

Almost all the racers were slaves. Win and you received a little money – win enough and you could buy your freedom. Scorpus won 2000 races before he was killed at 27. But Gaius Appuleius Diocles survived 4257 races to retire at 42 with winnings equivalent to $15 billon, making him the best paid sportsman of all time. And if you were lucky you might make it onto a mosaic. Essentially the billboard poster of Roman times.

Brought to you by Melanie Blake and Martin Humphrey.