Old crop UK wheat has eased about £3/t in the past week, as reports of new wheat imports filtered through the trade.

It is thought that there are three French ships heading our way, with 4000t heading for the South West, 11,000t heading for Northumberland, and possibly another heading for Ireland. Consequently July futures are trading at a smaller value than November futures for the first time. Last Friday, November wheat futures closed at £142.10, and as we write today is trading at £140. If we were to take an average of the past two months, the price of wheat would be around £139.00, so these markets are trading sideways.

If US maize really is the driver of our markets, then wheat price action is explained by the July Maize futures which have been trading at $3.70/b +/- 10 cents/b since mid-March. In fact this tight range has 'history' going back to 2014, so maize seems comfortable at these levels. The trade Bears hope prices will go lower due to cheaper prices in Brazil (with its estimated 100mt) and the forthcoming US harvest; the trade Bulls are looking at the huge short position of the funds and poor US crop conditions.

The Argentine maize harvest is slow with 38% harvested (5-year average 70%). The funds were 26mt net short of maize in the week ending 9th May and had slightly reduced this to 22mt by 23rd May. Maize planting in the US should proceed faster in the current dry weather, but maize planted in June onwards tends to produce lower yields, which with the potential quality issues in the months ahead, is price-supportive.

This week Coceral lowered their estimate of the EU soft wheat crop by 3mt to 142mt (136mt last year), due to the drought in Spain and lack of rain in Northern France. Having said that, this correspondent drove from Caen to Reims last weekend and the crops looked fantastic to his untrained eye, and more rain is forecast this weekend.

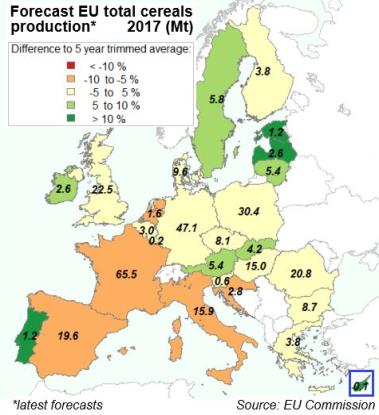

The EU barley crop is estimated at 57mt (60mt last year) which is would be the smallest crop for 5 years. In the UK we are hearing reports of more barley acres being planted this year. The EU believes that total grain production in the EU will be 305mt in 2017/18, which is 3.5% more than this year. The AHDB have produced this useful map of estimated EU cereal production by country.

The funds are about 15mt net short of wheat, 8mt net short of soya and 3mt net short of soya bean meal. The funds have increased their short position in recent weeks, and soya bean meal price has responded by falling about £10/t over the past few weeks, and is now about £280/t ex-port. The latest predictions are that Brazil will produce a record 115mt soya, as beneficial weather has boosted yields. In the period Jan-May Brazil has exported almost 35mt soya (31mt last year). In Argentina the harvest is about 85% complete.

The biggest airplane (by wingspan) ever built is ready to fly; it weighs about 540t and needs a 2 mile runway. It is designed to carry space rockets weighing up to 230t, to put satellites in space.

But what happens if the two pilots decide to go in opposite directions?

Regards,

Paul Poornan & Martin Humphrey