We are all suffering from the US weather market, it is dry in parts, raining in parts but generally the rain is missing the dry spots!

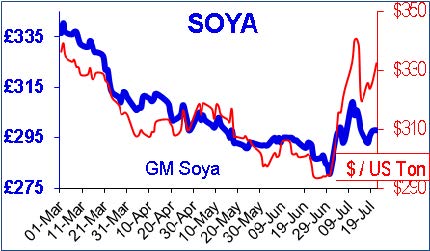

The sorry state of the spring wheat in a couple of US states brought the funds into play and as they went long (bought wheat), so prices went up. The USDA was not swayed by all the hype, and as bulls need feeding, the funds then sold and wheat prices have fallen to about halfway from the earlier peak. Soya prices followed a similar pattern and also fell by about 50% from the peak, but have since been slowly inching back upwards and are about 25% short of the peak. Winter soya prices are now sub-£300/t ex port. US maize prices fell further, but are also now trending higher like soya. Apart from the weather forecasts, the crop ratings, and the annual crop tour (starting next week) are also fodder for the bulls, so the market may well stay volatile with a tendancy towards being firm.

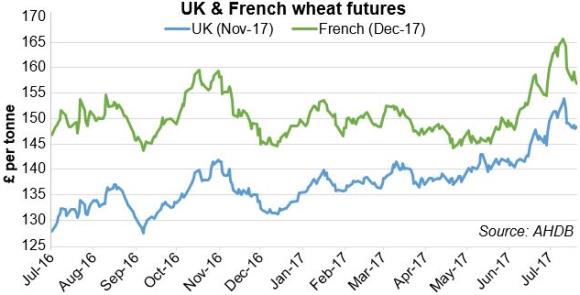

In Europe the harvest has started and wheat prices have followed the US drought scare to a peak about 10 days ago, but have generally fallen since then, possibly as EU harvest pressure kicks in. It is estimated that the French harvest is about 65% complete of which 66% is reported as good/very good condition (42% last year). Rain delayed the harvests and export programmes in Eastern Europe and the Black Sea, but initial reports are of better yields in Russia and they are hoping to reach last year’s record yields (72.5mt). Russian currency is strong which reduces the amount that farmers receive (in $), so farmers are reluctant sellers at a time when their export programme is in full swing which may actually force exporters to raise their bids. The 7-day rainfall forecast for the EU shows that rain in Northern France, Germany and the Ukraine which raises question marks about final yields and their quality.

In the UK prices have fallen about £5/t over the last week, but as always weather will be the final determinant of quality. November wheat futures finished at £148.55/t. Here in the south, it is surprising how well the standing crops have weathered recent storms. In terms of varieties planted it is thought that 40% of the planted wheat is Group 1 and 2, the highest proportion for a decade so beneficial to flour millers... if it keeps raining the feedmillers will be happy ;)

We are surprised at the US scare-mongering agricultural press who reported last week that: 'droughts are shrivelling high-quality wheat crops across the globe, sending prices to multi-year highs as bread makers scramble for supplies'; at least they had the courtesy to continue: ‘high-protein wheat has emerged as the one tight spot in a global grains market swamped with abundant stocks after four years of bumper harvests’. Consequently funds were selling CBOT wheat and buying MGEX spring wheat (Minneapolis Grain Exchange), as they finally realised the difference between milling and feed wheat, and that standard CBOT wheat was much too expensive to export. The USDA estimates that the abundant stocks will be a record high 260mt–so the world is hardly short of wheat.

A shopping centre in Shanghai has installed four glass play cabins for bored husbands. The 'husband resting hub' has a leather chair and a selection of 1990s video games. Some wives were pleased to shop without their guilty consciences in-tow, others were bored waiting for their husbands to finish their game. Another mall has opened a husband nursery. It all seems so strange, where is the pub?

Regards

Paul Poornan & Martin Humphrey