Concern is growing in Western Europe that little rain is forecast. Spain looks a little too dry and is currently a buyer of old crop wheat, and if the rain holds off, will be looking to import later this year.

Wheat in the UK and France definitely needs a good drink, especially for Spring planted crops. The May futures contracts in the UK, France and the US all expire in the next few weeks, so there may be some unusual technical volatility as the trade decides whether to release their positions, move them to new crop, or take delivery.

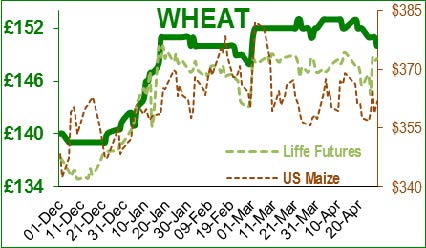

There are rumours of wheat being imported into the UK East coast to ensure continuous supplies of wheat in late June to harvest, much to the dismay of some arable farmers. On Monday, UK wheat was €172/t whilst French was about €163/t so more than €10/t to help cover the import costs. UK May wheat futures are trading at about £148/t (much the same as they have been since January).

Currency is a wildcard, as demonstrated by Sterling which rose against the $ and € when the UK election was announced. Then the £ dropped back against the € when the results for the first round of the French elections were released, but remained relatively strong against the $ (the best exchange rate since October). So currency, weather and the funds are currently the biggest threats to feedmill buyers (no change there then!).

Forthcoming threats include the US plantings, particularly if it becomes too wet to plant maize in the optimal time-frame, farmers will switch to planting soya instead. Then we face the phase of 'will the newly-planted US crops be damaged by the excess/lack of rain/sunshine/heat?' [delete as appropriate]. The growing season might as well be called the ‘crop scare season’, which tends to be more pronounced when there is a lack of fundamental news. So on that note, US maize is 17% planted (28% last year) delayed by rain and more forecast. US Winter wheat is benefitting from the rain, whilst Spring wheat planting at 22% has slowed (40% last year). The funds have sold more wheat, and US wheat prices fell $4/t this week and touched new contract lows. This was partly because of the funds, and partly because US farmers with grain stored at elevators needed to make decisions to price or roll it this week (May futures).

Demand for US soya has been falling in recent months, because the Chinese have (effectively) banned imports of US DDGs, which means that the excess DDGs is displacing soya in the US market; and also because the world can now buy new crop soya from South America. The Brazilian soya crop is 93% complete (5-year average 90%). The Argentinean soya harvest is not yet all in the barn, because rain is hampering harvest; but a record South American soya harvest is virtually guaranteed. Brazilian and Argentinean exchange rates are not great, so farmers are reluctant sellers; but there is enough soya available in the world to exert downward pressure on any inclination for price rises. Some US farmers have started to plant soya, with about 6% planted. GM soya is about £290 ex port.

Jeans. We have seen kids wearing ripped jeans since the 1970s (for those of you old enough to remember). Now a new generation of designers with no common sense are trying to shock the world: Jeans with caked mud £352, Jeans with a zip - where no zip should go, and transparent Jeans £55.

Reminiscent of the Emperor’s new clothes?

Regards,

Paul Poornan & Martin Humphrey