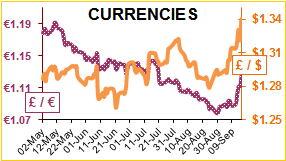

The star performer this week, with the strongest rise since January 2009 was Sterling, rallying to its highest value against $ since the Brexit vote last year. Against the €, Sterling also lifted 3.5% in a week. This rise was in response to news from the Bank of England’s MPC that an interest rate rise is likely to take place earlier than previously expected.

Whilst weaker Sterling increases the cost of imported commodities like soya, it counter-intuitively can also increase the price of domestic UK wheat. As Sterling weakens, whilst general UK exports become more competitive on international markets, for wheat markets it means that UK grain merchants can pay higher prices for the wheat, and still remain as competitive on export markets, so our wheat prices rise too.

Earlier this week, the USDA WASDE report was released, with marginally bearish data for wheat in general, but Australian wheat stocks were reduced 2.4Mln T. US markets reacted in their usual contrary manner; lifting in response to the bearish data! Russian wheat production was again lifted by 3.5Mln T to a new record of 81Mln T, however the trade believes that it could yet be further revised in due course to as much as85Mln T. FranceAgriMer lifted the French wheat crop by 1Mln T from last month to 37.8Mln T, and estimates that France will export 10 Mln T beyond the EU. Strategie Grains lifted its 2017 EU soft wheat production estimate by 1.5Mln T to 142.5Mln T, although it cut EU wheat exports 1.3Mln T to 23.1Mln T. Global old crop ending stocks also came in around 2Mln T lower at 227Mln T. UK crop trade estimates range between 14.5 and 15 Mln T, which leaves a small exportable surplus, and a relatively tight UK market. Last year’s tight UK market saw UK prices go in a different direction to World prices, what will happen this year?

Russian and Ukrainian wheat exports to Asia hit new highs in August due to supplies of cheap wheat increasing their market share. One consequence of the bountiful Black Sea harvests and the increasing rate of exports, is that the Baltic shipping index (which reflects the demand for freight) has hit a 3-year high.

This report has regularly referred to the large stocks of maize held in the huge Chines stores. Now the Chinese have come up with a novel way of addressing the surplus. Chinese media reported that China intends to introduce the nationwide use of ethanol in car fuel in order to help use vast corn stocks.

The USDA report increased the yield of the US soya harvest by 0.5 bushel per acre, which will push the yield up to 48.8 bushel per acre. This would push US production to its second successive record to over 120 Mln T.

US Soya prices have fallen nearly $50 since the beginning of the year, but the lower prices are acting as a disincentive to farmers to plant yet more soya. Plantings are down in Argentina for next year’s harvest, and the same is expected in the US for the next crop.

Palm oil prices, which drive the world vegetable oil prices, are expected to weaken due to a recovery in palm seed production.

Lower crude oil prices put pressure on the Russian rouble which is a major export origin for wheat, particularly at this time of year.

Many farmers have an affinity for tractors, a number of customers have a selection of old tractors that they are particularly proud of. I am sure that a number of us first learnt to `drive’ with a tractor, and so may have done silly things with tractors. But would you use it as a stunt machine? Gaggi Bansra, from the Punjab has been working on his stunts for 4 years, whilst working in his father’s fields. Amongst his many stunts, he can make his tractor wheelie for 100m. Gaggi is trying to get his name into the Guinness World Records. “I want the world to see what I can do with my mean machine."