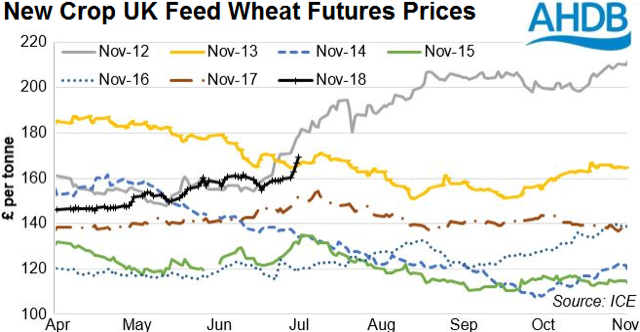

Over the last 6 trading days, UK November wheat futures hit a recent high of £173/T, then fell back to £164/T and closed the week at £169.50/T following the release of the USDA report.

Old crop wheat is suffering from a different sort of North-South divide – in the North there are buyers, but no sellers, whereas in the South the reverse is true. Wheat prices are being driven by currency, Brexit and Trump but the UK market is also following the EU markets, which in turn is trying to follow the US. Dryness is still the main topic with Strategie Grains reducing its wheat production to 132.4 Mln T from 139.9 Mln T for 18/19.

With the UK harvest near the industry awaits answers to questions on crop size and quality but predictions are as low as 13.5 Mln T and with some regions already importing it expected that the UK will be a significant importer in the 2018/19 season. UK feed wheat futures prices closely resemble those seen in Nov 2012 season (see AHDB graph).

The USDA report gave a two part look into the global grain crop for the coming year. Lower crop yields are reported for many regions including the EU, Russia and Australia, reducing global stocks by 5 Mln T for wheat and 3 Mln T for maize. US yields are higher due to increased acreage. US prices have dropped due to this and because its major export markets are no longer so friendly with the US. The continued threat of trade tariffs between the US and China etc are not conducive to trade, but the global stocks and supply situation is such that US crops will eventually find a home. However trade supply chains will have to be re-written.

As reported previously, soya prices have fallen due to the reaction of the funds and trade to the Chinese tariffs which target US soya. At one point it looked as if a `bottom’ was forming, but following additional tariffs this week, US August soya bean futures hit new contract lows at the end of the week, pushed lower after China said that it would not need US soya this year, and that it would use alternative protein sources. Prices are so low, that it would pay South American crushing plants to buy US soya. It seems that the trade war is still creating enough new volatility to ensure it remains the market focus over weather and world demand. This week’s USDA report lowered exports and starting stocks for 2018/19 but increased the crush and end stock predictions reflecting the impact of losing Chinese market share. It is expected that other markets will continue to take advantage of the low US soya price to take up the slack left by China.

Archaeologists with drones have helped discover ancient drawings in the Peruvian desert and changed thoughts on their function and meaning. Many of these lines and drawings, known as geoglyphs (literally ground drawings), are known about in the sandy soil of Nazca province. They were thought to be connected to rituals for rain. Following damage caused to the famous “hummingbird” a restoration project started.

Location was poorly documented so the team used drones to map them from the air. As many of these images had faded to become almost completely erased they were not discovered until 3D images from the drone allowed faint depressions in the soil to become visible. The discovery was not just of more drawings but of two distinct types. The iconic Nazca lines from 200-700 A.D. are mostly only visible from overhead and featured mostly lines. Whereas the older Paracas glyphs, thought to be from as early as 500 B.C. were laid on hillsides often depicting figures. This indicates these drawings were not only a much earlier tradition but a transition between cultures and meaning. Read more here.