Currencies

Sterling took a step back this week falling to 6 week lows against both the € and the $ following the perceived slow down in the pace of vaccination because of the negative press around the AstraZeneca vaccine. This shows how closely currency is still linked with the pandemic, and any perceived bump in the `road to recovery’ back to ‘normal’ will mean we continue to see currency buffeted by every bit of news. Now that we have entered the next stage of our road out of lockdown, economic spending data will become a key driving force.

Wheat

Wheat markets have been steadily firming this week on continued weather fears across US, Canada and Europe. The weather has turned cold again, with continued dryness and as mentioned before, with little to no snow coverage in those areas now, there are concerns about both the wheat and maize crop development.

The WASDE report last week reduced the overall wheat production down slightly to 776.68 MlnT, but this was less than 0.5 MlnT different from the previous report, so the market did not seem to have taken much notice. The report was seen as more bullish for corn with stocks calculated to be 1.7 MlnT below trade estimates, and the 2021 US planted area being down 2%, which rallied corn markets and also offered more underlying support to the wheat markets.

In the UK, planting reports have indicated 63% good/excellent vs 49% this time last year which is positive, but the cold dry weather here will be closely monitored now. UK prices are currently up £9 on the week.

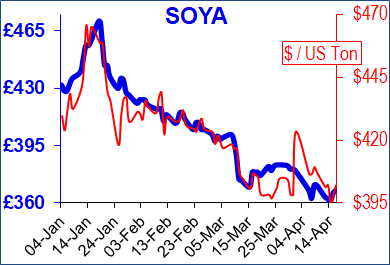

Soya

Soya prices have eased back after their initial highs following the USDA report which lowered the US planted acreage from 90 Mln acres to 84 which was the biggest miss calculation by the trade since 2009. China have been using their reserves, which are now at 10 month lows but the question remains if they are doing this because they plan to buy in at a later date or is this due to increased cases of Asian Swine Flu again? Brazilian tonnages have been increased slightly again to 136 MlnT but Argentina stays the same at 47.5 MlnT. With the £ currently at a low, there will be better days to buy soya as this could be costing as much as £10-15pt, however, it feels as though we are unlikely to get back to sub £300 per tonne anytime soon.

And Finally…

The three things Britons missed the most- Hairdressers, Pubs and Primark!

For the first time in 3 months, the high street, hairdressers and pub gardens were allowed to welcome back customers and it would appear that customers took full advantage of the opportunity.

Many pubs opened at 12pm and brave customers sat outside in the cold and in some parts of the country, snow to enjoy their first pint. Several pubs took to social media to report their busiest non bank holiday Monday sales ever with several saying they had been drunk dry!

Many hairdressers and beauty salons extended their opening hours to receive their first customers just after the stroke of midnight, with many happily fully booked for the next 4-6 weeks.

Perhaps the biggest surprise for retail though were the queues which formed outside Primark stores across the country as the opened their stores at 7am with queues beginning to form from as early as 5am!

Regards,

Kay Johnson & Martin Humphrey